In today’s rapidly evolving digital landscape, e-commerce has become an indispensable part of global commerce. For businesses seeking to thrive online, selecting the right e-commerce payment gateway is paramount. This comprehensive guide will delve into the intricacies of payment gateways, providing you with the knowledge necessary to make informed decisions and unlock seamless transactions for your online business. We’ll explore the key features, benefits, and considerations involved in choosing a payment gateway that perfectly aligns with your specific business needs, ensuring smooth and secure payment processing for both you and your customers. Understanding the nuances of e-commerce payment gateways is essential for maximizing sales and fostering customer trust in the competitive world of online retail.

Navigating the world of online payments can be daunting, but with the right information, you can unlock the full potential of your e-commerce platform. This guide will equip you with a clear understanding of how e-commerce payment gateways function, enabling you to optimize your online transactions and create a frictionless checkout experience. From security measures to integration options, we’ll cover the crucial aspects of selecting and implementing an effective payment gateway. By mastering the essentials of e-commerce payment processing, you can enhance customer satisfaction, streamline operations, and drive sustainable growth for your online business. Join us as we demystify the complexities of online payments and empower you to choose the ideal payment gateway for your e-commerce success.

Understanding the Basics of E-Commerce Payment Gateways

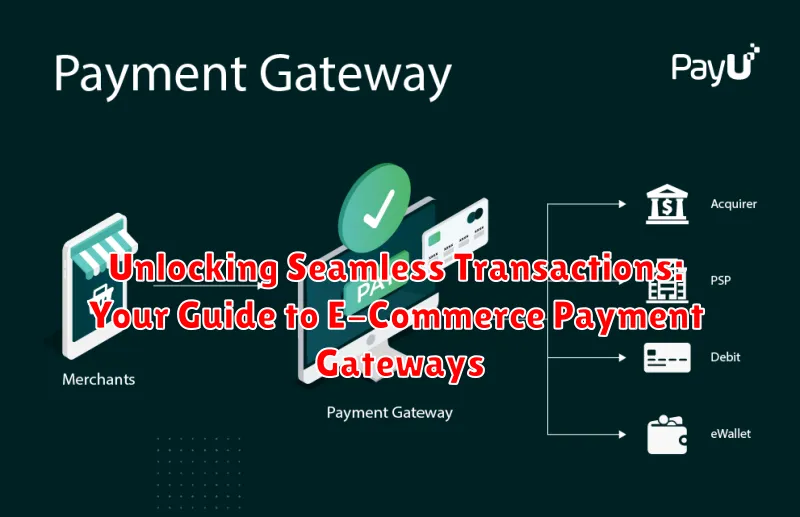

In the simplest terms, an e-commerce payment gateway is a technology that acts as a bridge between your online store and the payment processor. It securely authorizes payments for online transactions, ensuring smooth and efficient transfer of funds.

Think of it like this: when a customer makes a purchase on your website, the payment gateway takes the customer’s payment information and transmits it securely to the payment processor. The processor then communicates with the customer’s bank and the merchant’s bank to approve or decline the transaction. Finally, the gateway sends the transaction results back to your website, allowing the purchase to be completed.

Essentially, payment gateways facilitate the transfer of sensitive payment data, protecting both the customer and the merchant from fraud. They are crucial for accepting credit and debit card payments online, and often support other payment methods like digital wallets.

How Payment Gateways Work: A Step-by-Step Process

A payment gateway acts as a bridge, securely connecting your online store to the payment processor. Here’s a simplified breakdown of the process:

-

Customer Initiates Purchase: The customer adds items to their cart and proceeds to checkout.

-

Payment Information Entered: The customer enters their payment details on your secure checkout page.

-

Gateway Securely Captures Data: The payment gateway encrypts the sensitive data and transmits it securely to the payment processor.

-

Request Sent to Payment Processor: The payment processor communicates with the customer’s issuing bank to verify the funds.

-

Authorization Received (or Declined): The payment processor sends an authorization response back to the payment gateway.

-

Confirmation Relayed to Merchant: The payment gateway relays the authorization (or decline) to your online store.

-

Order Fulfilled: Upon successful authorization, you can then fulfill the order.

Types of Payment Gateways: Exploring Your Options

Choosing the right payment gateway is crucial for a smooth checkout experience. Several types of gateways cater to different business needs. Understanding these distinctions helps in selecting the most suitable option.

Hosted Payment Gateways

With hosted gateways, customers are redirected to a third-party page to complete their payment. This option simplifies PCI compliance for merchants, as sensitive data is handled off-site. However, the redirect can slightly disrupt the customer journey.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to stay on your website throughout the entire transaction. This provides a more seamless experience but increases the security responsibility for the merchant.

API Hosted Payment Gateways

API hosted gateways offer a blend of control and security. While the payment processing occurs through an external system, merchants can customize the look and feel of the payment form to match their branding.

Local Bank Integrators

These gateways connect directly to a local bank’s payment system, often streamlining the process within a specific region. This option can be advantageous for businesses operating primarily in one country.

Key Features to Look for in a Payment Gateway

Choosing the right payment gateway is crucial for a successful online business. Here are key features to consider:

Security

Security is paramount. Look for gateways with PCI DSS compliance, fraud prevention tools like address verification and CVV checks, and data encryption to protect sensitive customer information.

Supported Payment Methods

Offering a variety of payment options improves the customer experience. Ensure the gateway supports major credit and debit cards, digital wallets (like Apple Pay and Google Pay), and potentially other methods like ACH transfers depending on your target market.

Transaction Fees and Pricing

Understand the fee structure. Consider transaction fees (percentage or flat rate), monthly fees, and any setup or chargeback fees. Compare different providers to find the most cost-effective solution for your business.

Integration and Compatibility

Seamless integration with your existing e-commerce platform is essential. Check for compatibility with your shopping cart software and other business tools. A smooth integration minimizes technical complexities and simplifies the checkout process.

Customer Support

Reliable customer support is vital for troubleshooting any issues. Look for gateways that offer 24/7 support via phone, email, or live chat. Prompt and efficient support can minimize downtime and maintain a positive customer experience.

Benefits of Using a Payment Gateway for Your Online Store

Integrating a payment gateway offers numerous advantages for your e-commerce business, streamlining transactions and enhancing the customer experience. Here are some key benefits:

Increased Security

Payment gateways encrypt sensitive customer data, reducing the risk of fraud and data breaches. This protection builds trust and encourages customers to confidently shop on your platform.

Improved Customer Experience

Offering a variety of payment options through a gateway caters to a wider customer base. The streamlined checkout process contributes to a positive shopping experience, encouraging repeat business.

Faster Processing Times

Automated payment processing through a gateway reduces manual intervention, leading to faster transaction times. This efficiency translates to quicker order fulfillment and improved customer satisfaction.

Reduced Operational Costs

Automating payment processing minimizes administrative overhead associated with manual reconciliation and tracking. This cost savings can contribute significantly to your bottom line.

Global Reach

Many payment gateways support multiple currencies and international payment methods, allowing you to expand your business into new markets and reach a global customer base.

Choosing the Right Payment Gateway for Your Business Needs

Selecting the right payment gateway is a critical decision for any e-commerce business. The right gateway can streamline transactions, enhance customer experience, and boost sales, while the wrong one can lead to frustration and lost revenue.

Several factors influence this decision. Transaction fees are a primary consideration. Different gateways charge different fees per transaction, and these can significantly impact your bottom line. Consider your average transaction value and sales volume when evaluating fee structures.

Supported payment methods are another key factor. Your target audience may prefer certain payment methods over others. Ensure the gateway supports the methods your customers use, whether it’s credit cards, debit cards, digital wallets, or other options.

Security is paramount. Choose a gateway with robust security features like encryption and fraud prevention tools to protect your business and your customers’ sensitive data. Look for PCI DSS compliance as a baseline requirement.

Finally, consider the integration process. Choose a gateway that seamlessly integrates with your existing e-commerce platform to minimize technical challenges and ensure a smooth setup.

Integrating a Payment Gateway with Your E-Commerce Platform

Integrating a payment gateway is crucial for accepting online payments. The process typically involves several key steps. First, you’ll need to select a compatible payment gateway that aligns with your platform and business needs. Many popular e-commerce platforms offer pre-built integrations with various gateways, simplifying the process significantly.

Next, you’ll need to create an account with your chosen payment gateway provider. This usually involves providing business information and verifying your identity. Once your account is active, you’ll receive API keys and credentials necessary for connecting the gateway to your platform.

The integration process itself often involves installing plugins or extensions, or configuring API settings within your e-commerce platform’s admin panel. Clear documentation and support from your payment gateway provider are essential during this stage.

Testing the integration thoroughly is paramount before going live. This ensures that transactions are processed correctly and securely. Test transactions with various card types and amounts to validate functionality and identify any potential issues.

Security Considerations for E-Commerce Payment Gateways

Ensuring the security of your e-commerce payment gateway is paramount for protecting both your business and your customers. Choosing a gateway with robust security measures is critical.

Look for features like PCI DSS compliance, which establishes a baseline of security requirements. Tokenization replaces sensitive card data with unique tokens, reducing the risk of data breaches. 3D Secure authentication adds an extra layer of verification for online transactions, minimizing fraudulent activities.

Fraud detection and prevention tools are also crucial. These tools monitor transactions for suspicious patterns and can help prevent fraudulent purchases. Regularly reviewing and updating your security protocols is vital in adapting to evolving threats and vulnerabilities.

Future Trends in E-Commerce Payment Gateways

The landscape of e-commerce payment gateways is constantly evolving. Several key trends are shaping the future of online transactions, promising even more seamless and secure experiences for both businesses and consumers.

Invisible Payments are gaining traction. These streamline the checkout process by making the payment step almost invisible to the customer. Think automatic payments within apps or one-click purchases.

Biometric Authentication is enhancing security and convenience. Fingerprint scanning and facial recognition are increasingly being used to verify customer identity, minimizing fraud and simplifying the payment process.

The rise of Mobile Wallets continues. Digital wallets like Apple Pay and Google Pay offer a quick and easy way to pay online, further reducing friction at checkout.

Artificial Intelligence (AI) is playing a larger role in fraud detection and prevention. AI-powered systems can analyze transaction data in real-time, identifying and blocking suspicious activity more effectively than traditional methods.